Greetings to all our readers

Welcome to the Spring edition of the Safeguarding Newsletter from the MITSkills Safeguarding Team. We aim to bring you all the latest, relevant help and advice on issues we feel will be of importance to you. In this issue, we talk about financial exploitation because young people are being targeted and their bank accounts or online wallets are being used to launder money by individuals or criminal groups.

Financial exploitation – What is ‘financial exploitation’?

Financial exploitation can take many forms. In this context, we use the term to describe exploitation which takes place for the purpose of money laundering. This is when criminals target children and adults at risk and take advantage of an imbalance of power to coerce, control, manipulate, or deceive them into facilitating the movement of illicit funds. This can include physical cash and/or payments through financial products, such as bank and cryptocurrency accounts.

Financial exploitation is a form of criminal exploitation, or child criminal exploitation when the victim is under 18 years old. It can take place in isolation or alongside other forms of exploitation.

What can it look like?

Criminals use complex methods to exploit their victims, including coercive control, threats of violence, and offering an exchange. A financial or other gain is often a core component of financial exploitation, where alongside other harmful exploitative actions, criminals will purport to offer them a benefit in exchange for the ability to use their account. The victim will not necessarily be aware that the funds the perpetrator is directing them to move through their account are the proceeds of crime. Victims may also be coerced into handing over control of bank accounts to the perpetrator – this could be an existing account, or one specifically opened with their personal details under direction of the perpetrator.

Methods used by criminals to exploit financial exploitation.

Exploitation is typified by some form of power imbalance which perpetrators use to force, coerce, and groom victims into illegal activity. Criminals use a variety of techniques and methods to exploit their victims either online or in person. These can appear unsophisticated or organised, and victims may have been exploited even if the activity appears consensual.

While more evidence is needed to better understand the methods used by the perpetrators of financial exploitation, some examples of the methods used for other sorts of exploitation include:

- offering an exchange – criminals can offer victims a benefit of some sort in exchange for the use of their account. This can include money, physical possessions such as clothes, digital goods, and online assets. Other benefits can include perceived status or friendship, protection, a sense of belonging and identity, or affection.

- physical violence or threats of violence – used to intimidate or punish victims or their families. This might involve weapons, including knives and firearms or the use of other violent crime to intimidate, including robbery.

- emotional abuse or psychological coercive control – by manipulating, threatening, controlling, or monitoring the movements of the victim. This includes examples where the victim may believe they are in a relationship with the perpetrator.

- extortion – by forcing victims to commit a crime so they can hold it over them and threaten to report it if they do not comply.

- abduction or kidnapping – victims can be forcibly moved and held in a location away from home.

- sexual abuse – this can be experienced by all sexes, genders, and sexual orientations.

- debt bondage – a form of entrapment when a victim owes money to their exploiters and is made to repay their debt, either financially or through another means. The exploiter may groom the victim by initially providing money or goods which the victim will then be made to pay back. The exploiter may also deliberately manufacture a debt. For example, criminals might stage a robbery of drugs or cash in the victim’s possession to ensure the victim will continue to perform tasks for them. The debt may also be inherited from family members. Banks often detect and freeze criminal funds. In such situations, criminals might insist that victims ‘owe’ them the funds, creating debt bondage.

Case study

Harry is a 14-year-old boy living in foster care. Harry was approached on Snapchat by someone claiming to be a similarly aged girl called Isabelle. In reality, ‘Isabelle’ was a fake persona created by an older, male criminal – a perpetrator of exploitation.

Over the next fortnight, the older man used the fake persona of ‘Isabelle’ to deceive Harry into believing that they were in a relationship, and that Harry could trust them. The man manipulated Harry into sharing a sexually intimate video of himself, and then used it to extort Harry into handing over his bank details. Harry was told that if he refused the video would be sent to everyone at his school.

The criminal then used Harry’s bank account to launder the proceeds of crime. When Harry’s foster carer found out that the account was being controlled by someone else, they closed the account immediately but took no further action.

In response, the criminal extorted Harry into getting the bank details of other children at his school by again threatening to share the video with everyone if he refused.

This case study demonstrates one way in which a person can be subjected to multiple forms of exploitation, with perpetrators using malicious techniques to manipulate and deceive for criminal purposes. Here Harry was a victim of both child sexual and financial exploitation and was coerced into doing things.

Who is vulnerable to financial exploitation?

Any child or adult at risk can be a victim of financial exploitation as perpetrators continue to adapt who they target to avoid detection. A person of any sex, gender, sexual orientation, background, religion, belief or race – in any location – can be approached by the criminals behind money mule networks. Educating people about the risks of this sort of financial exploitation is a key preventative measure. The government has published a Money Mule and Financial Exploitation Action Plan detailing its approach to protecting victims and disrupting criminality in this area.

The NCA assesses that it is highly likely that the criminals behind money mule networks use social media as their main method of exploiting potential victims and recruiting criminal money mules. Figures published by Cifas and UK Finance suggest that in the first six months of 2023, 23% of all accounts reported as bearing the hallmarks of money muling activity were owned by young people aged 21 and under

Indicators that a person is a victim of financial exploitation

Observations from cross-sector organisations responding to financial exploitation suggest that the following might be indicators of financial exploitation. They include people:

- Changing their banking behaviour. This might include receiving large or unexplained deposits into a bank account.

- Becoming more secretive, especially about their finances.

- Opening new accounts with banks or crypto exchanges. This is especially relevant for those which can be opened online or through an app.

- Becoming more protective about the ability of others (for instance their parents) to access or view their bank accounts.

- Having bank accounts closed unexpectedly, difficulties opening new ones or accessing other financial services.

- Receiving excessive letters from banks or debt collectors.

- Changing their use of cash and frequency of ATM withdrawals.

MIT Safeguarding Team

The MITSkills Safeguarding Team have been trained to an advanced level on all aspects of safeguarding. The team is available to any student, parent, or staff member to discuss and report any safeguarding concerns.

The Team Members are as follows:

Company Safeguarding

Officer

Claire Clark

Call-0300 303 2225

Company Safeguarding

Lead

Stuart Francis

Call-07716116694

Sport Safeguarding

Lead

Liam Hughes

Call-07510025851

MIT Safeguarding Team Email:

safeguarding@mitskills.com

Additional support available

Mental Health First Aiders

Our trained mental health first aiders are the point of contact for anyone who is experiencing a mental health issue or emotional distress. This interaction could range from having an initial conversation through to supporting the person to get appropriate help.

In a crisis, our Mental Health First Aiders can provide early intervention help for someone who may be developing a mental health issue. Our Mental Health First Aiders are not trained therapists or psychiatrists, but they can offer initial support through non-judgemental listening and guidance.

To access this support email either Iva.Icheva@mitskills.com , Liam.Hughes@mitskills.com or stuart.francis@mitskills.com for an informal non-judgemental chat.

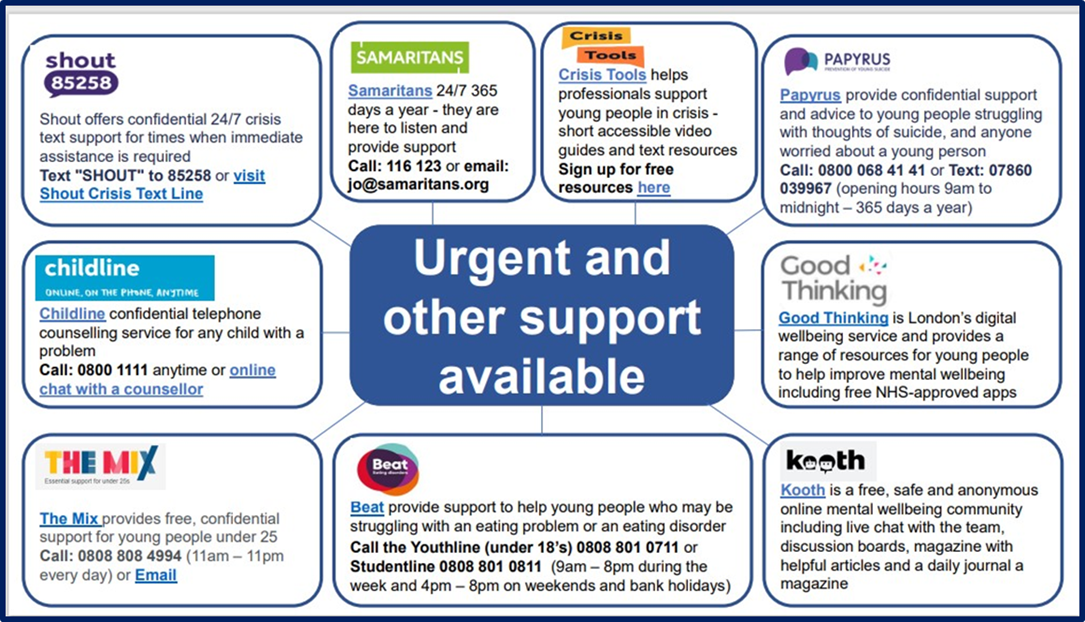

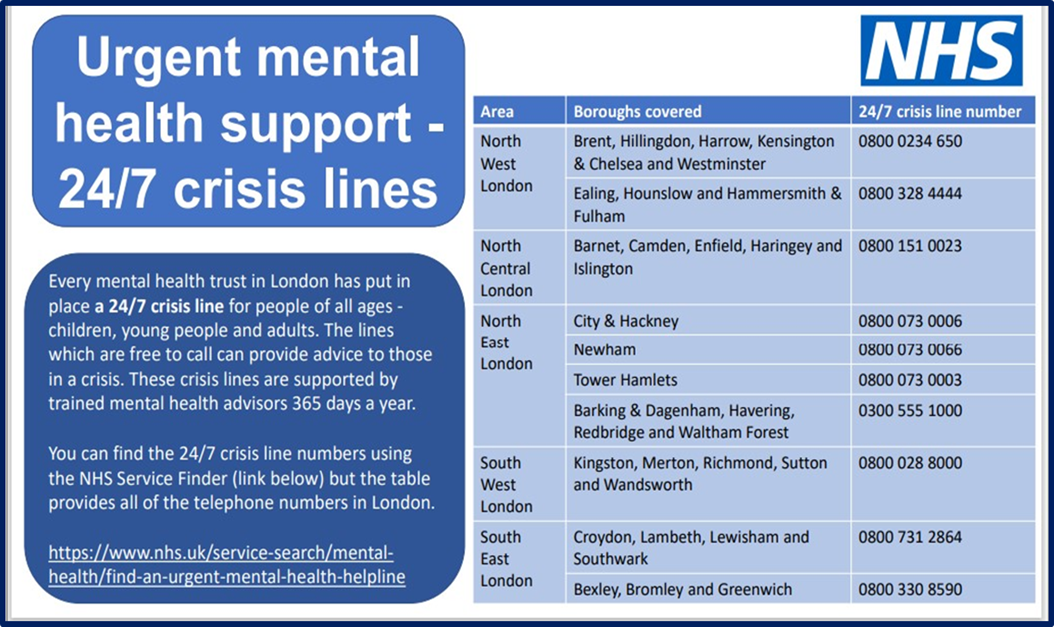

Support Helplines London

Support Helplines Rotherham and Humber

Support Helplines in West Yorkshire

General UK wide helplines